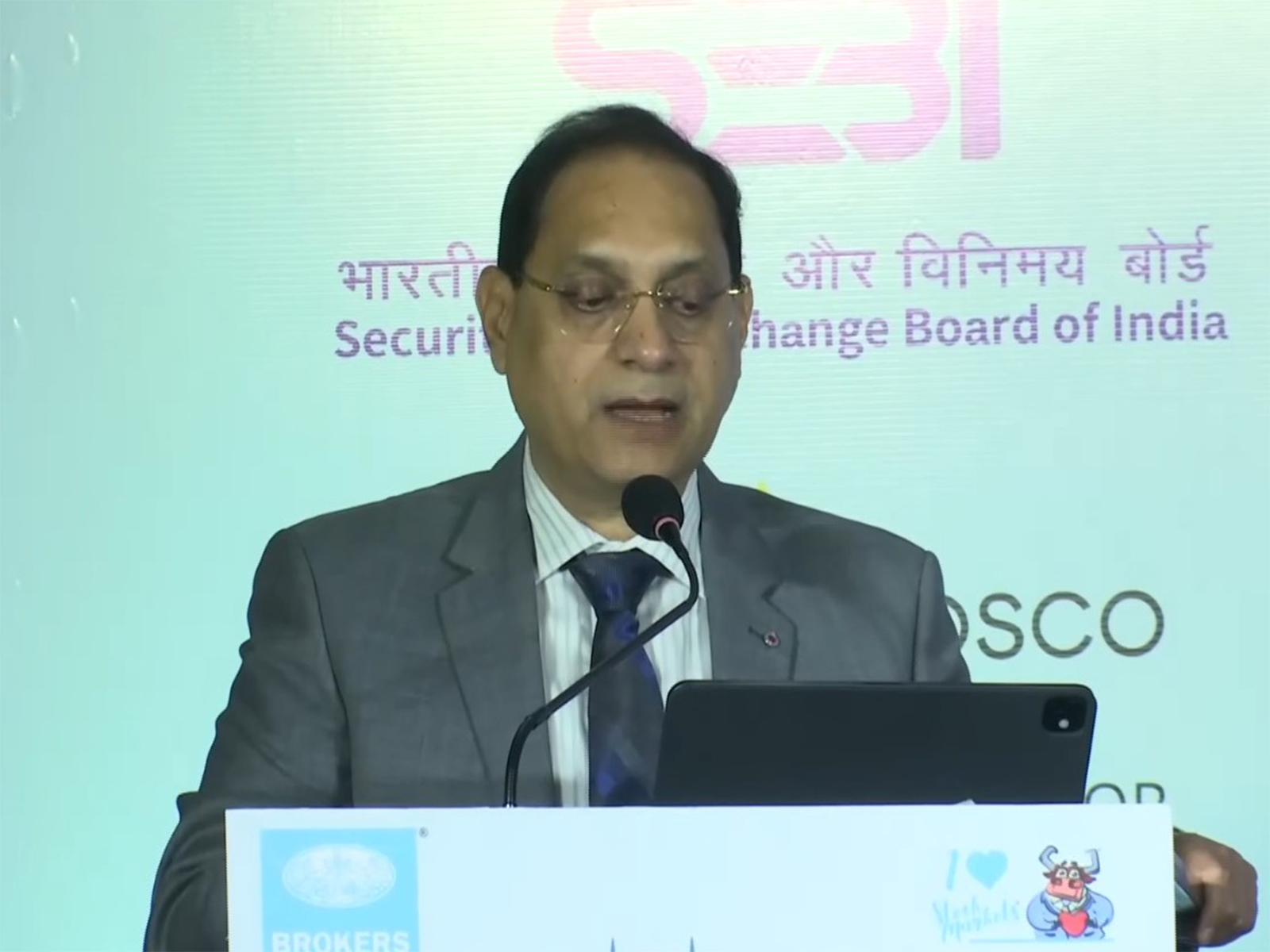

Mumbai (Maharashtra) [India], October 12 (ANI): SEBI Chief Tuhin Kanta Pandey highlighted the urgent goal of establishing an easy and secure KYC access for Non-Resident Indians (NRIs) to facilitate their participation in the securities market.

Addressing the BFF Capital Market Confluence 2025 in Mumbai, he said that while SEBI has simplified KYC norms and allowed transactions and securities as soon as the process is completed, the system for NRIs still needs to be streamlined.

“We have a long way to go in investor awareness. We have simplified KYC norms and permitted transactions and securities as soon as this process is completed. However, we are yet to establish an easy and secure KYC access for NRIs to facilitate their participation in the security market this will be an urgent goal for us,” Pandey said.

He emphasized that a resilient market is one with broad, deep, and informed participation.

Referring to a recent nationwide survey, Pandey pointed out that while 63 per cent of households are aware of securities products, only 9.5 per cent actively participate. Participation in urban areas is significantly higher at 15 per cent, compared to 6 per cent in rural regions, which aligns with expectations.

The survey also revealed that only 36 per cent of investors possess high or moderate knowledge of the securities market, indicating a considerable gap in awareness.

Highlighting the scale of India’s securities infrastructure, the SEBI chief said, “On any given day, our stock exchanges handle a staggering volume of activity. In the last financial year, they processed an average of over 1,600 crore messages daily, with a peak of over 2,900 crore messages. Behind these numbers is the trust of crores of investors. This is the trust we must always protect.”

Pandey outlined SEBI’s strategic pillars for market resilience, starting with technology.

He noted the rapid growth of algorithmic and high-frequency trading, which currently accounts for significant volumes in equity and derivatives markets. SEBI will continue to update its regulatory framework to ensure a fair, transparent, and resilient market.

On cybersecurity, he warned that an attack on a single institution could destabilize the entire ecosystem.

“We have issued a comprehensive cyber-security and cyber-resilience framework. Guidelines for clear gaps, a key component, will be issued in consultation with MIIs. Our MIIs are being stress-tested with live disaster recovery drills. We have implemented redundancy models for peering corporations and are examining safety nets for depository participant outages, as done for soft brokers,” he added. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages