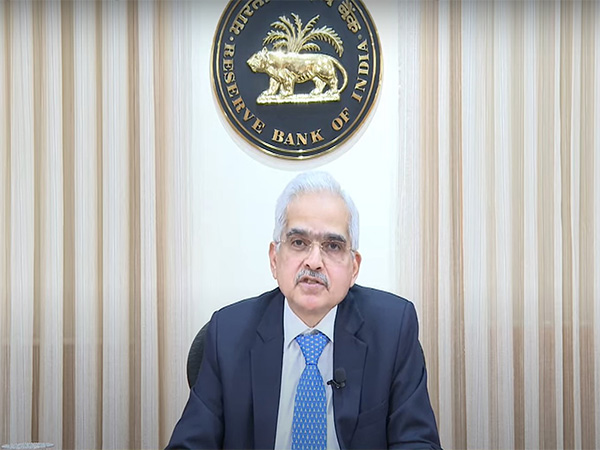

Mumbai (Maharashtra) [India], August 8 (ANI): The Reserve Bank of India (RBI) has announced measures to check unauthorized lending Apps and to prevent consumers from such illegal practices. RBI Governor Shaktikanta Das has proposed to create a public repository of digital lending Apps (DLAs) to check such practices

“The Reserve Bank proposes to create a public repository of DLAs deployed by its regulated entities. The regulated entities (REs) will report and update information about their DLAs in this repository. This measure will help the consumers to identify the unauthorised lending apps” said Governor Das

Das added that the move will assist the efforts to establish a robust digital lending ecosystem in the country.

“The Reserve Bank has taken several measures for the orderly, development of the digital lending ecosystem in India. As a further measure in this direction, and to address the problems arising from unauthorized digital lending apps,” the RBI Governor said.

The regulated entities of RBI will have to report updated information about their digital lending apps to the repository. The creation of the depository will help the consumers to identify the unauthorized lending apps. Unauthorized lending apps are mobile apps that impersonate real lenders and steal personal and financial information. Last year the government banned and blocked 138 betting apps and 94 loan lending apps with Chinese links on an ‘urgent’ and ’emergency’ basis.

Other new initiatives announced in the monetary policy include increasing the limit for tax payments through UPI from Rs 1 lakh to Rs 5 lakh per transaction. This will further ease tax payments by consumers through UPI.

The RBI also introduced a facility of “Delegated Payments” in UPI. This would enable an individual (primary user) to allow another individual (secondary user) to make UPI transactions up to a limit from the primary user’s bank account without the need for the secondary user to have a separate bank account linked to UPI. This will further deepen the reach and usage of digital payments.

In another big announcement to facilitate MSMEs and small traders RBI has announced that now cheques will be cleared on a real-time basis i.e. within hours of the presentation earlier it used to take two days.

“At present, cheque clearing through the Cheque Truncation System (CTS) operates in a batch processing mode and has a clearing cycle of up to two working days. It is proposed to reduce the clearing cycle by introducing continuous clearing with ‘on-realisation-settlement’ in CTS. This means that cheques will be cleared within a few hours on the day of the presentation. This will speed up cheque payments and benefit both the payer and the payee.”

The RBI has also increased the frequency of reporting by credit information companies. At present lenders are required to report credit information to companies every month or as short intervals as agreed upon, now they have to give this on a fortnightly basis.

“It is proposed to increase the frequency of reporting of credit information to a fortnightly basis or at shorter intervals. Consequently, borrowers will benefit from faster updation of their credit information, especially when they repay their loans. The lenders, on their part, will be able to make better risk assessment of borrowers,” said governor Das. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages