VMPL

New Delhi [India], July 26: Nuvama initiates coverage with a ‘BUY’ rating and a TP of INR1,448, valuing the stock at 1x FY26E NAV. AGI Infra (AGIIL) is among the few reputed real estate players in Punjab, with a dominant presence in Jalandhar, aided by a strong track record of well-received, high-quality projects. Operating in a market with limited branded competition, it has established a strong position and is strategically expanding into high-demand micro-markets across Punjab. With a robust development pipeline and a sizable, well-located land bank, it is well-positioned to capitalise on Punjab’s growing housing demand. Our confidence in its long-term growth story is aided by a structurally buoyant home market.

Report link: https://agiinfra.tiiny.site

Key growth Drivers are highlighted below:

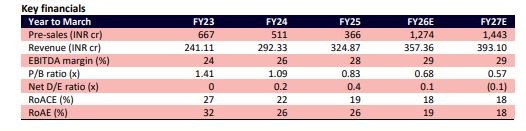

i.Pre-sales CAGR of 13% over FY26-30E on the back of a strong launch pipeline of ~INR5,120cr (9.8msf) and ongoing inventory of ~INR1,280 (4.98msf);

I. Strong demand for its product and further price realisation;

II. In-house construction using its team of experts, coupled with the use of Mivan technology, which gives it an edge in terms of faster execution, on-time delivery, and boosts margin;

III. Favourable dynamics in Punjab with lower inventory and limited supply by branded players;

IV. Net cash surplus of INR2,060cr over FY26-32E (sans its land bank) led by pre-sales growth;

V. With a large land parcel spread across diverse locations, where demand is high, it is ready for the future. We expect a net cash surplus of INR1,506cr and a healthier Balance Sheet led by strong collections and internal accruals (net D/E ratio to improve to -0.1x in FY27E from 0.2x as of March).

It has ten/four ongoing/upcoming projects, with an inventory/saleable area of 4.98msf/9.8msf (GDV of ~INR1,280cr/~INR5,120cr). Well-diversified land reserves of ~12.2msf will be used for future development. We expect GDV of ~INR1,280/~INR5,400cr ongoing inventory/upcoming to be liquidated by FY30 and envisage a cash surplus of ~INR2,060cr from ongoing and upcoming projects. We see project additions once it launches most of its existing projects. We value AGIIL on its FY26E NAV considering its land reserves and ability to add projects aggressively in its existing micro-market given its brand value and improved Balance Sheet.

Organised real estate players gain an edge in underserved

Punjab micro-markets Its more than two decades of experience helps it stand out among Punjab’s few organised players. Jalandhar and Ludhiana are among the fastest-growing realty markets in the region, with strong traction seen in recent years. We expect continued demand and price appreciation given: i) its luxury positioning, and ii) the presence of an affluent client base. Limited supply from organised players, better infrastructure, and rising aspirations are driving demand for branded residential projects.

Proven execution and strategic Tier II presence backed by a diversified portfolio

AGIIL’s expertise lies in residential development, with a portfolio evenly balanced between luxury and affordable housing. This ensures access to a diversified client base and resilience across market cycles. It has delivered ~9msf across 10 successful projects in Jalandhar. It is expanding in key high-growth micro-markets in Tier II cities where demand is robust. Leveraging Mivan technology and in-house execution, it is ensuring faster project execution, greater durability, and reduced labour and overhead costs. With a sizeable land bank in Tier II cities and a proven execution track record, it is best placed to sustain margin and capitalise on rising demand for branded and quality housing across Punjab.

Ongoing and upcoming projects total ~14.8msf; launches seen till FY30

It has significantly scaled up given: i) the favourable market dynamics, ii) timely delivery of premium projects, and iii) strong demand for completed projects, leading to healthy collections and efficient capital recycling via internal accruals. It has 10 ongoing projects (eight residential and a commercial and plot each) with an inventory of ~4.8msf. Four upcoming projects (residential/commercial: three/ one), with a saleable area/GDV of 9.8msf/~INR5,120cr, will be launched by FY30. We expect the entire ongoing inventory to get liquidated by FY28-end.

Expect a cash surplus of ~INR2,060cr over FY26-32; Net debt to equity to decline -0.1x in FY27

We expect ongoing and upcoming residential projects to generate a gross/net cash flow of INR8,283cr/INR2,060cr over FY26-32. We foresee a net D/E ratio of -0.1x by FY27 from 0.5x as of FY25on healthy internal accruals.

Recommend buy with TP of Rs 1,448

We recommend Buy with a target price of Rs1,448 (upside of 36%). Our Buy recommendation is drive by 1. Well located land bank 2. Experienced management 3. Strong execution 4. Strong demand 5. Healthy cash flows 6. Comfortable balance sheet 7. Attractive valuations. Expect healthy cash flows aided by: i) the development of land parcels, ii) strong brand positioning, and iii) price premium in Punjab. We discount cash flows to FY26 to arrive at a NAV of INR3,539cr with a TP of INR1,448. Maintain BUY.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages